The Ins and Outs of PrimeXBT Funding

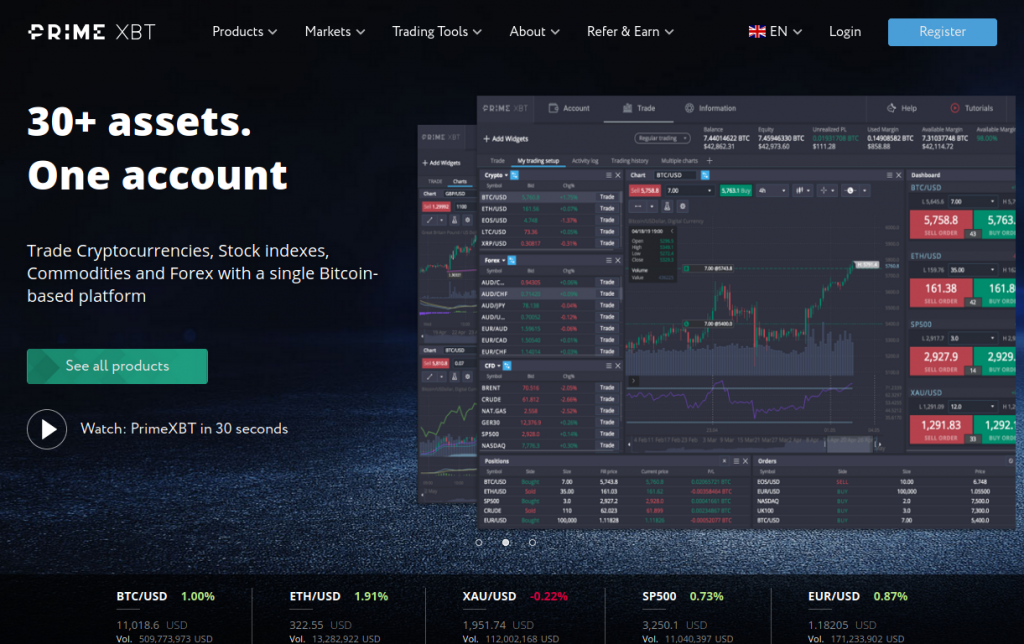

In the rapidly evolving world of cryptocurrency trading, PrimeXBT Funding PrimeXBT funding stands out as a crucial aspect that every trader should comprehend. As a platform that facilitates margin trading, PrimeXBT has become increasingly popular due to its comprehensive offering, allowing traders to engage with various assets while utilizing leverage. Understanding how funding works on PrimeXBT can significantly enhance your trading experience, enabling you to make informed decisions and maximize your profits. This article will delve into the essential elements of PrimeXBT funding, its mechanisms, related terminologies, and how traders can better utilize it in their trading strategies.

What is PrimeXBT Funding?

PrimeXBT funding refers to the process by which traders pay or receive interest based on their open positions on the platform. In essence, it’s a cost associated with the leverage that traders utilize for their trades. When traders open a leveraged position, they borrow funds from the platform, and as a result, they may need to pay a funding fee depending on the duration of their position and the nature of the market (bullish or bearish).

How Does Funding Work on PrimeXBT?

The funding mechanism operates on a straightforward premise. Every hour, the funding rates are determined based on the current supply and demand dynamics of the asset being traded. If there are more buyers than sellers, the funding rate may become positive, meaning long positions will pay a fee to those who hold short positions. Conversely, if there are more sellers, the funding rate may turn negative, indicating that short positions pay fees to long positions. This system ensures that the market remains balanced, incentivizing traders to take positions that align with prevailing market conditions.

Understanding Funding Fees

Funding fees are calculated based on the size of your position and the prevailing funding rate at the time. For instance, if you’re holding a long position and the funding rate is positive, you’ll incur a fee that is calculated hourly. It’s essential for traders to be aware of these fees, especially if they plan on holding their positions for an extended period. Not factoring in these costs can lead to unexpected losses that can significantly affect your trading portfolio.

Strategies to Manage PrimeXBT Funding Costs

To make the most of PrimeXBT funding while minimizing costs, traders can adopt several strategies:

- Short-Term Trading: By focusing on short-term trades, traders can circumvent the impact of funding fees, as they won’t hold positions long enough to incur significant costs.

- Market Timing: Understanding market trends can help traders determine when to enter or exit positions to avoid unfavorable funding rates.

- Hedging: Utilizing hedging strategies can mitigate funding fees and allow traders to protect their investments during adverse market conditions.

The Impact of Funding Rates on Trading Decisions

Funding rates can dramatically influence a trader’s decisions. A consistently high funding rate may indicate strong bullish sentiment in the market, prompting traders to take long positions. However, if funding rates remain elevated for an extended period, it could also suggest an impending market correction, leading traders to reconsider their strategies. Awareness of funding rates, therefore, is integral to making prudent trading decisions.

Conclusion

In summary, understanding PrimeXBT funding is essential for anyone serious about trading on the platform. By grasping how funding fees operate, traders can better manage their positions and enhance their overall trading strategies. Whether you are a seasoned trader or just starting, these concepts are vital to ensuring your trading journey on PrimeXBT is rewarding and profitable. For anyone looking to maximize their trading potential, staying informed and aware of PrimeXBT funding dynamics will undoubtedly provide a competitive edge.

Further Resources

To further enhance your understanding of PrimeXBT funding and trading strategies, consider exploring educational resources, webinars, and community forums. Engaging with other traders can provide invaluable insights and tips that can help you navigate the complexities of margin trading effectively.